If you’re a first-time homebuyer eyeing Aurora, you’re probably wondering — can I really afford it? The answer is yes, with the right game plan and a little help from programs designed just for you.

Buying your first home in Aurora can feel both exciting and a bit overwhelming. With prices hovering in the mid-$400s to $500s, breaking into the market takes more than just browsing listings; it takes strategy, preparation, and smart use of available resources.

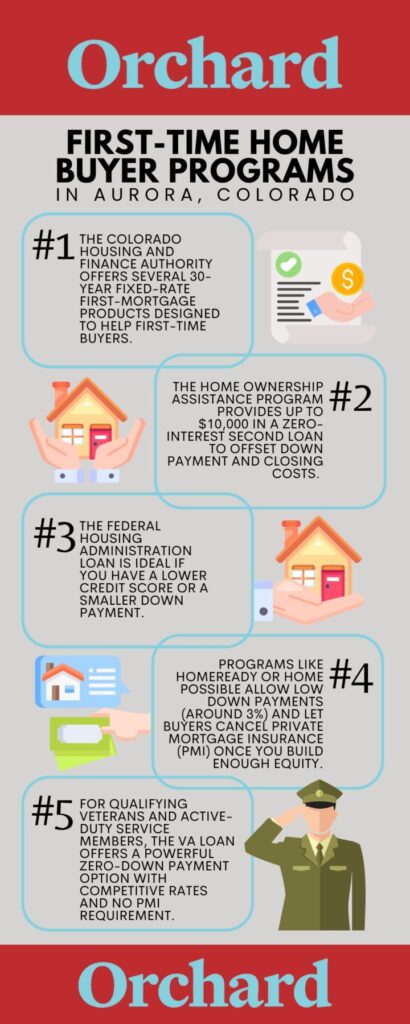

Fortunately, Colorado offers a strong network of support for first-time buyers — from statewide options through the Colorado Housing and Finance Authority to local programs like Aurora’s Home Ownership Assistance Program.

This guide walks you through the essentials: current market context, Aurora CO home buyer programs, and the step-by-step process of purchasing your first residence in Aurora.

Aurora’s Housing Market Context

For a first-time home buyer, Aurora is a market that offers some opportunity, but also invites care and planning.

Current data show that median sale/list home prices in Aurora are commonly in the ballpark of $460,000 to $500,000 for all home types. For instance, one report shows the typical home value in Aurora at about $463,247 as of April 2025.

That said, certain ZIP codes or higher-amenity neighborhoods push well above $550,000 (especially for single-family homes in desirable pockets).

So, depending on the specific ZIP code (say 80010 versus 80016), your personal affordability expectations should adjust accordingly.

Because Aurora lies in a higher-cost region of the Denver metro area (Adams County, Arapahoe County, Douglas County), the conforming and FHA loan limits are elevated.

For example, the FHA single-unit home purchase limit in Adams and Arapahoe Counties is $833,750 for 2025. The conventional (conforming) limit for a single-unit property in those counties is also about $833,750.

These higher limits mean that even though prices are elevated compared to many parts of the country, you may still access “conforming” financing (lower rate, standard underwriting) for a larger amount than in typical markets.

In Colorado generally, closing costs (excluding prepaid items like taxes or insurance) for a purchase loan tend to fall in the neighborhood of 0.5% to 1.5% of the loan amount.

In a market like Aurora where prices are $450K to $500K, that might mean $2,500 to $7,500 (on top of your down payment) as a rough guideline.

When planning to buy home in Aurora, it’s wise to budget on the higher end if the deal has more complexity or if the property is a bit above average in price.

Statewide Assistance: The CHFA Ecosystem

The key state resource for homebuyers is the Colorado Housing and Finance Authority (CHFA).

CHFA plays the role of Colorado’s primary state authority for affordable homeownership financing—offering loan programs, down-payment and closing-cost assistance, and education for buyers.

Since 1974, CHFA has helped a large number of buyers across the state achieve homeownership.

CHFA First Mortgage Products

CHFA offers several 30-year fixed-rate first-mortgage products (for example: FirstStep, SmartStep, Preferred) that are designed to help different buyer types—first-time buyers, veterans, targeted-area buyers.

These products typically offer competitive pricing and are available through CHFA-participating lenders. The idea is that you first qualify for a CHFA mortgage, then layer on assistance if eligible.

CHFA Down Payment Assistance (DPA)

CHFA’s DPA options break down into two major categories:

Grants

Assistance funds that do not require repayment. CHFA’s Down Payment Assistance Grant offers up to the lesser of $25,000 or 3% of the first mortgage amount.

Second-Mortgages (Deferred Loans)

Zero-interest, deferred second loans that are repaid when you sell, refinance, or pay off the first mortgage. These can provide up to 4% (or more) of the first mortgage amount.

These DPA funds can significantly reduce the upfront burden of down payment and closing costs.

Mortgage Credit Certificate (MCC)

CHFA also participates in the federal Mortgage Credit Certificate program—a tax credit equal to a portion of the mortgage interest you pay annually (instead of just a deduction). It lowers your federal income tax liability and can improve monthly affordability.

Local Aurora Homebuyer Resources

While CHFA covers Colorado as a whole, Aurora also has local programs worth knowing.

Home Ownership Assistance Program (HOAP)

The City of Aurora offers this dedicated assistance for first-time (and first-time equivalent) buyers within city limits. The program provides up to $10,000 in a zero-interest second (silent) loan to offset down payment and closing costs.

It’s a helpful local supplement, but buyers should verify current application status, as some city programs are periodically paused or restructured.

Homebuyer Education Requirement

For virtually all DPA programs—statewide via CHFA and local via the City of Aurora—you must complete a CHFA-approved (or equivalent) homebuyer education course and obtain the certificate of completion.

CHFA states that the certificate is valid for 12 months. The City of Aurora also offers in-person and online options.

Geographic Eligibility

Most state and local assistance programs cover Aurora across Adams and Arapahoe Counties. It’s important to verify that your specific ZIP code or property is eligible for the program you choose.

Federally Backed Loan Types for First-Timers

FHA Loans

The Federal Housing Administration (FHA) loan is ideal if you have a lower credit score or a smaller down payment. Down payment is typically 3.5%, and the 2025 FHA loan limit for a single-unit home in Aurora’s counties is $833,750.

Conventional Loans

(HomeReady/Home Possible)

If you qualify for a conventional loan, programs like HomeReady or Home Possible allow low down payments (around 3%) and let you cancel private mortgage insurance (PMI) once you build enough equity.

VA Loans

For qualifying veterans and active-duty service members, the VA loan offers a powerful zero-down payment option with competitive rates and no PMI requirement.

The Application Process Timeline

Initial Steps

Start by building your budget, checking your credit, and completing the required homebuyer education course. This class isn’t just a formality—it helps you understand homeownership responsibilities, mortgage terms, and ongoing costs.

Finding a CHFA-Approved Lender

Work with a lender experienced in CHFA programs. They’ll help determine which CHFA product fits and coordinate the DPA process.

Getting Pre-Approved

In Aurora’s competitive market, pre-approval shows sellers you’re serious and helps you act fast when you find the right home.

Underwriting and Closing

Once under contract, your lender and CHFA will underwrite your loan. DPA can add a few extra steps to the process. After final approval, closing usually occurs within 30–45 days, covering inspections, appraisal, and final paperwork.

Frequently Asked Questions

What are the minimum credit score requirements for CHFA DPA programs?

CHFA generally requires a minimum credit score of 620 for most of its first-mortgage programs.

Do I need to be a first-time homebuyer to use CHFA programs in Aurora?

It depends on the product. Some programs require you to be a “first-time equivalent” buyer (no ownership in the last three years), while others allow repeat buyers in targeted areas.

How much can I receive for down payment assistance in Aurora?

Under CHFA, you may receive up to the lesser of $25,000 or 3% of the first mortgage for a grant, or up to 4% (or more) through a deferred second mortgage. The City of Aurora’s HOAP offers up to $10,000, depending on eligibility and funding.

Are there income limits to qualify for the CHFA FirstStep program?

Yes. CHFA sets household income limits that vary by county, program type, and household size.

Does the mandatory homebuyer education certificate expire?

Yes, the certificate is valid for 12 months, and you must be under contract before it expires.

Can I use a CHFA DPA grant to cover closing costs instead of the down payment?

Yes. CHFA’s DPA funds can be applied to down payment and/or closing costs, depending on the product guidelines.

How does the Mortgage Credit Certificate (MCC) save me money every year?

The MCC provides a federal income tax credit for a portion of the mortgage interest you pay, reducing your tax bill and improving monthly affordability.

Do I have to repay the CHFA second mortgage if I refinance my home?

Yes. Most deferred second mortgage programs require repayment if you sell, refinance, or stop occupying the home as your primary residence.

Is my specific Aurora ZIP code eligible for all local and state programs?

Not always. State programs apply statewide, but the City of Aurora’s HOAP is limited to properties within city limits. Always verify with your lender or program administrator.

Key Takeaway

If you’re looking to buy in Aurora and feel the barrier to homeownership—especially the down payment and closing costs—is high, Down Payment Assistance (DPA) is your most powerful tool.

Pairing a CHFA loan with state or local assistance gives you a realistic path into homeownership in the Denver metro region.

Early action is everything: complete your education course, get pre-approved, and partner with a lender familiar with DPA programs. With preparation and the right guidance, you can confidently turn Aurora’s vibrant housing market into your new home address.

Have further questions about home buyer programs in Aurora, CO? feel free to contact me through 702-506-5006 or leahceller@gmail.com.