When buying or selling a house in Colorado, understanding closing costs is important.

This article offers a guide on what home buyers and sellers can expect to pay when finalizing a real estate transaction.

Understanding Closing Costs

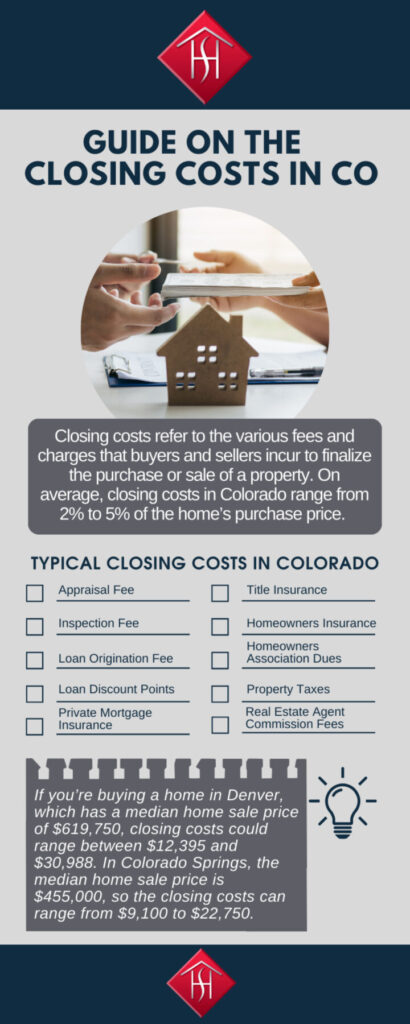

Closing costs refer to the various fees and charges that buyers and sellers incur to finalize the purchase or sale of a property.

Generally, both buyers and sellers can expect to pay closing costs. Typically, buyers pay closing costs out of pocket, while the closing costs for sellers are deducted from the home sale proceeds.

At this point, you’re probably wondering, “How much are closing costs in Colorado?”

Read on to learn more.

Credit: Image by Max Vakhtbovycn | Pexels

Typical Closing Costs in Colorado

Generally speaking, average closing costs in Colorado can range anywhere from 2% to 5% of the home’s purchase price.

For example, if you’re buying a home in Denver, which has a median home sale price of $619,750, closing costs could range between $12,395 and $30,988. In Colorado Springs, the median home sale price is $455,000, so the closing costs can range from $9,100 to $22,750.

To give you an idea of what buyers and sellers pay in closing costs, refer to the table below:

| Buyer’s Closing Costs | Seller’s Closing Costs |

|---|---|

| Appraisal Fee | Real Estate Agent Commission Fees |

| Inspection Fee | Homeowners Association Fees |

| Loan Origination Fee | Property Taxes |

| Loan Discount Points | Title Insurance |

| Private Mortgage Insurance (PMI) | Transfer Taxes |

| Title Insurance | |

| Homeowners Insurance | |

| Homeowners Association Dues | |

| Property Taxes |

Credit: Image by Kindel Media | Pexels

Buyer’s Closing Costs

How much are closing costs in Colorado for buyers?

If you’re a home buyer, it would help to know how much your closing costs would amount to so you can prepare your budget accordingly.

Appraisal Fee

Home appraisal fee is the amount of money that a professional appraiser will charge in order to determine the fair market value of a Colorado property. This costs between $600 and $850.

Inspection Fee

A home inspection can bring to light potential issues and help buyers determine whether a property is a wise investment. A home inspection fee generally ranges from $300 to $500.

Loan Origination Fee

This fee covers the cost of processing your loan application and is usually calculated as a percentage of the total loan amount, which is typically between 0.5% and 1.5%. At Speak Straight Mortgage we for 0 lender fee’s an 95% of our loan programs. See this video for details on loan costs https://youtu.be/8w4NkDPAFs8?si=PkASHe6V6hB25uRv

Loan Discount Points

Buying discount points can lower your interest rate by 0.25% to 0.5%. A one-time fee at closing will be required, calculated as 1% of the mortgage value. See this video for a detailed breakdown of points https://youtu.be/8w4NkDPAFs8?si=PkASHe6V6hB25uRv

Private Mortgage Insurance (PMI)

When your down payment is below 20%, you’ll be required to pay PMI. Generally, this costs between 0.5 and 1% of the total loan amount per month.

Title Insurance

Both the lender’s title insurance and the owner’s title insurance are typically paid by the buyer. On average, the buyer pays $1 to $1.75 per $1,000.

Homeowners Insurance

In Colorado, buyers may need to prepay certain expenses, such as homeowners insurance, which costs $3,820 on average.

Homeowners Association Dues

For homes in HOA-managed communities, the buyer might have to pay one month’s dues at closing. This can range from $100 to $1,000. The more amenities and services a community offers, the higher the HOA fees.

Property Taxes

In Colorado, buyers need to pay a portion of the property taxes at closing. This state has some of the lowest residential property taxes in the country, with an average effective rate of 0.48%.

Credit: Image by Max Vakhtbovycn | Pexels

Seller’s Closing Costs

How much are closing costs in Colorado for sellers?

The closing costs paid by sellers in the Centennial State may vary, but below are some of the common fees and costs they cover.

Real Estate Agent Commission Fees

Traditional fixed-rate commissions can be a significant cost for sellers. However, starting in August 2024, real estate commissions may be more negotiable.

Homeowners Association Fees

The seller is responsible for settling any outstanding HOA fees or assessments up to the closing date.

Property Taxes

The seller shoulders unpaid property taxes that have accrued up to the closing date. These taxes are typically prorated for the months that the property is owned by the seller.

Title Insurance

In Colorado, it is common for the seller to pay for title insurance. This protects the buyer in case of a problem with the title.

Transfer Taxes

Paying state and local transfer taxes is a responsibility of the seller. These taxes are typically a percentage of the property’s sale price and vary by jurisdiction.

Conclusion

Closing costs are an inevitable part of a real estate transaction, something that both buyers and sellers need to anticipate. It is important to know what these are and how much these will cost.

Whether you’re planning to buy or sell a Colorado home, partnering with a knowledgeable real estate agent who understands the local market can help ensure that you get the best deal from your property purchase or sale.

If you have any questions about closing costs in Colorado, you may give me a call at 702-506-5006 or send me an email at leahceller@gmail.com to schedule an appointment.

Frequently Asked Questions

What are the typical closing costs for a home in Colorado?

For buyers, typical closing costs include appraisal fees, inspection fees, loan origination fees, loan discount points, private mortgage insurance, title insurance, homeowners insurance, homeowners association dues, and property taxes.

For sellers, common closing costs include real estate agent commission fees, homeowners association fees, property taxes, title insurance, and transfer taxes.

Who pays the closing costs in Colorado?

Both the buyer and the seller are responsible for closing costs in Colorado. It is important to note that closing costs are not set in stone, and both parties may negotiate who pays what during the settlement of their real estate transaction.

Can closing costs be included in the loan?

Yes, closing costs can be included in a mortgage loan. This is called “rolling” closing costs into a loan. However, rolling closing costs into a loan will result in paying interest on the closing fees, so you’ll end up paying more for your mortgage in the long run.

Are closing costs tax-deductible?

Points you buy to reduce your loan interest rate and property taxes you pay in advance may be tax deductible.