Aurora, CO, is a vibrant and diverse city that has captivated the hearts of many with its spectacular natural beauty, endless opportunities for outdoor recreation, flourishing arts scene, and rich cultural heritage.

Compared to neighboring cities, Aurora housing is more affordable, making it an attractive choice for those looking to purchase a home.

This article provides helpful information on how to access affordable housing in Aurora, CO, detailing the process and available programs.

Understanding Affordable Housing in Aurora, CO

Affordable housing in Aurora, CO, refers to housing options where the household spends 30% or less of its gross monthly income on housing costs. This includes rent or mortgage and other housing-related expenses such as utilities, insurance, etc.

The city is actively working to increase the availability of affordable housing, partnering with organizations like the Aurora Housing Authority (AHA) to ensure that there is a sufficient supply of homes for its residents.

The AHA manages various affordable housing units, including those with income-based rent restrictions. It also offers subsidized or rent-assisted units through Public Housing and Project-Based Voucher programs.

Having more affordable housing options create a better potential for residents to thrive. Aside from providing safe shelter to residents, affordable housing supports economic growth, community health, educational institutions, and neighborhood development.

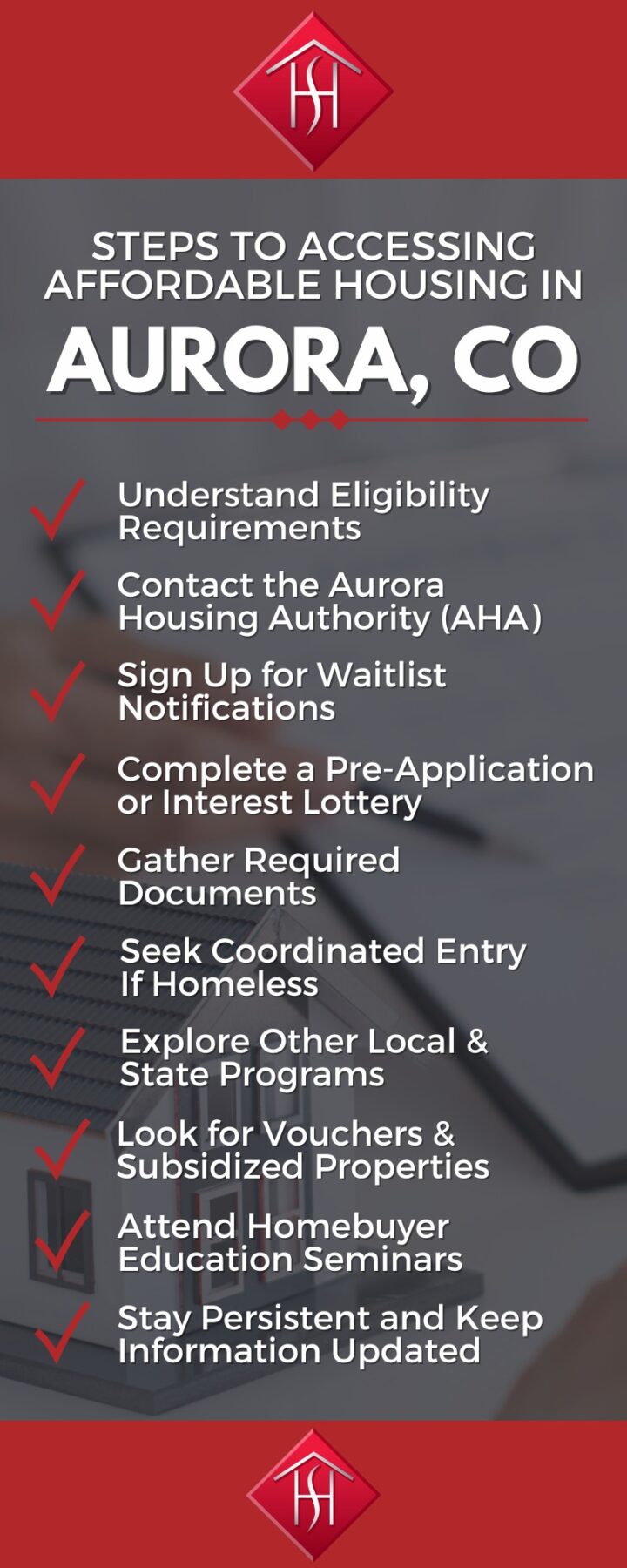

10 Steps to Accessing Affordable Housing in Aurora, CO

1. Understand Eligibility Requirements

In general, applicants need to meet income limits, be US citizens or eligible non-citizens, and fulfill suitability requirements such as background checks to qualify for affordable housing Aurora, CO programs.

2. Contact the Aurora Housing Authority (AHA)

The Aurora Housing Authority (AHA) is the primary administrator of both the Housing Choice Voucher (HCV) program and the Public Housing programs in Aurora, CO.

3. Sign Up for Waitlist Notifications

To sign up for waitlist notifications for Aurora housing programs, visit the Aurora Housing Authority website and subscribe to their email list.

4. Complete a Pre-Application or Interest Lottery

Once you have subscribed to AHA’s mailing list for updates on when waitlists open, you can fill out the application portal on their website.

The AHA uses a computerized random selection process or lottery to establish placement on the waiting list, and chosen applicants are notified with instructions to start the eligibility process.

5. Gather Required Documents

Specific requirements can vary based on the program and property, so it’s important to review the requirements of the program or property you are interested in.

6. Seek Coordinated Entry If Homeless

The Coordinated Entry System (CES) is a process designed to connect homeless individuals and families, or those at risk of homelessness, with appropriate housing and resources.

7. Explore Other Local & State Programs

Several local and state programs in Aurora, CO, support affordable housing, including the Housing Development Grant Funds and various housing voucher programs.

8. Look for Project-Based Vouchers & Subsidized Properties

Project-based voucher (PBV) and subsidized properties are available for affordable housing through the Aurora Housing Authority (AHA).

9. Attend Homebuyer Education Seminars if Applicable

Aurora, CO, offers free Homebuyer Education seminars that provide future homebuyers with helpful information about the home-buying process and ways to qualify for other assistance programs.

10. Stay Persistent and Keep Information Updated

Promptly report any changes in your income, household composition, or contact information to the relevant agencies.

Conclusion

Aurora, CO, offers more affordable housing, making this vibrant and diverse city an attractive choice for those looking to purchase a home.

If you would like to explore the homes and neighborhoods in Aurora, CO, please give me a call today at 702-506-5006 or send me an email at leahceller@gmail.com to schedule an appointment.

Frequently Asked Questions

How do I apply for Section 8 in Aurora, CO?

To apply for Section 8 or the Housing Choice Voucher Program in Aurora, CO, you need to apply through the MyHousing Applicant Portal of the Aurora Housing Authority (AHA).

The AHA typically opens its waitlists at specific times. These are announced on the AHA website. It is recommended for applicants to sign up for email notifications to be updated on waitlist openings.

What are the income limits for affordable housing in Aurora?

Income limits for affordable housing in Aurora, CO, vary depending on the specific program and the number of people in the household. The best resource to find income limits for affordable housing in Aurora is the AHA website.

Does the Aurora Housing Authority have a waiting list?

Yes, the Aurora Housing Authority has a waiting list. You can check the Program Status page on their website for the latest information on when the waiting list might reopen.

Where can I find emergency housing assistance in Aurora, CO?

For emergency housing assistance in Aurora, CO, the primary resources are 2-1-1 Colorado and the Aurora Day Resource Center.

What is the difference between Public Housing and Housing Choice Vouchers in Aurora?

To receive Public Housing assistance, one must live in one of AHA’s communities or high-rises, while someone receiving a Section 8 voucher rents a privately owned unit and receives Aurora rental assistance.

Are there resources for homeless individuals in Aurora, CO?

Yes, there are various resources available for homeless individuals in Aurora, CO, including emergency shelters, drop-in centers, housing programs, and mental health services.

What documentation is needed to apply for housing assistance in Aurora?

To apply for housing assistance in Aurora, CO, specifically through the Aurora Housing Authority, applicants need to provide documentation demonstrating their eligibility, such as proof of citizenship or eligible immigration status, and verification that income and family size does not exceed 80% of the median income for the area.